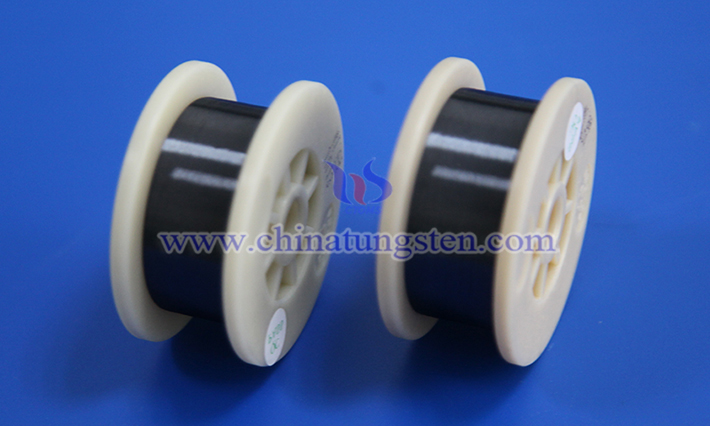

As the global energy structure shifts toward low-carbon solutions, the photovoltaic (PV) industry, a cornerstone of clean energy, faces intense market competition and technological upgrade pressures. Recent fluctuations in silicon wafer prices, industry production cuts, and policy guidance have introduced new challenges and opportunities for the PV supply chain. Among these, tungsten wire, a key consumable in diamond wire cutting, has garnered significant attention due to its advantages in enabling thinner wires for silicon wafer cutting.

According to data from the Silicon Industry Branch of the China Nonferrous Metals Industry Association, current silicon wafer prices have fallen below the cash costs of most operating companies, forcing significant production cuts. Starting in July, major silicon wafer manufacturers plan to reduce operating rates by approximately 40% to stabilize prices. On July 9, Securities Times reported that several silicon wafer companies raised their quotes by 8% to 11.7%, driven primarily by the pass-through effect of rising upstream polysilicon prices. However, with slower growth in downstream demand, the acceptance of these price increases by battery manufacturers remains uncertain.

The Ministry of Industry and Information Technology (MIIT) has issued clear policy directives for the PV industry, emphasizing lawful and comprehensive measures to address low-price, disorderly competition. These policies encourage companies to enhance product quality, promote the orderly exit of outdated capacity, and achieve healthy, sustainable development. Additionally, they advocate for strengthened international cooperation to accelerate the development of next-generation PV products, aiming to establish China as a technological leader in the global PV industry and a key player in the global low-carbon energy transition. These policies provide a foundation for the standardized development of the PV supply chain.

In this context, the PV industry’s “anti-involution” production cuts may temporarily reduce demand for tungsten-based diamond wire (a consumable for silicon wafer cutting). Tungsten diamond wire, with its ability to enable thinner wires, significantly reduces silicon material usage compared to traditional carbon steel wire. However, low silicon wafer prices and production cuts have temporarily restrained demand growth for tungsten-based materials and slowed the replacement of carbon steel wire with tungsten wire.

In the long term, as silicon wafer prices recover and industry profitability gradually improves, the PV sector is expected to enhance its overall value through standardized competition and accelerated technological upgrades. Tungsten diamond wire, with its advantages in thin-wire technology, efficiency improvements, and cost optimization, is projected to see rapidly increasing penetration rates. Looking ahead, tungsten wire, as a critical consumable, will play an increasingly vital role in the PV industry’s technological advancements and high-quality development, injecting new momentum into the sector’s sustainable growth.