Analysis of Latest Tungsten Market from Chinatungsten Online

I. Tungsten Product Price Increases Since 2025

As of press time, the price increases of tungsten products in this round since late March 2025 are as follows:

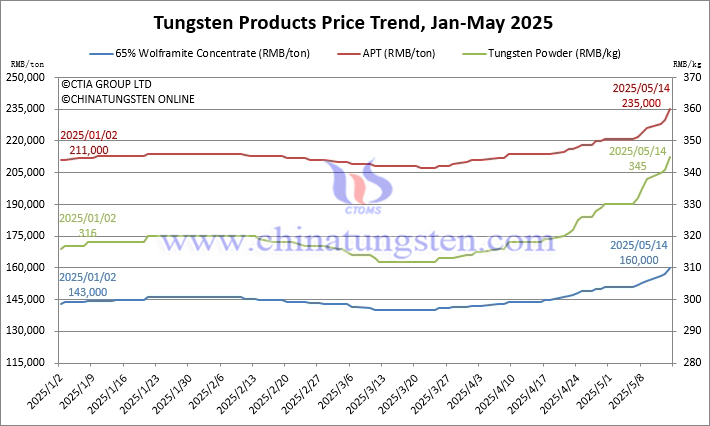

Tungsten Concentrate

An increase of 14.3%, with the price of high-grade ore breaking through the RMB 160,000/ton mark, setting a new historical high.

Ammonium Paratungstate (APT)

An increase of 13.5%, with the price rising to RMB 235,000/ton in line with the ore end, and market liquidity is relatively slow.

Tungsten Powder and Tungsten Carbide Powder

An increase of 10.5%, with prices reaching RMB 345/kg and RMB 340/kg respectively, continuing a situation of high prices with no market supply.

Ferrotungsten

An increase of 13.0%, driven by costs and rigid demand, pushing the price to a new high of RMB 244,000/ton.

Tungsten Cemented Carbide

An increase of 5%-20%, due to rising raw material prices and production costs, companies are passively raising prices again, putting pressure on the consumer end.

II. Multiple Factors Driving the Surge in Tungsten Prices

1. Tungsten Resource Supply Side

Domestic Tungsten Mining Total Volume Restricted

China's first batch of tungsten mining total volume control indicators for 2025 is 58,000 tons, a decrease of 4,000 tons compared to the same period in 2024, a reduction of 6.45%, indicating a significant compression of the total control volume.

Insufficient Increase in Overseas Primary Tungsten Ore

Although overseas tungsten mining projects in Australia, South Korea, Canada, Vietnam, etc., plan to expand production, the investment intensity is insufficient, the construction cycle is long, and there are shortcomings in smelting technology, making it difficult to fill the global supply gap in the short term. The global tungsten concentrate production still heavily relies on China, and the high concentration of resources keeps tungsten resource prices at a relatively high level.

Waste Tungsten Recovery and Application Need Improvement

The recycling industry chain for tungsten scrap is immature, the process is complex, with high energy consumption, high costs, and low efficiency; waste tungsten has many impurities (>5%), making purification difficult, affecting quality, and it does not have a significant cost advantage over primary tungsten, with obvious quality disadvantages. At the same time, recycling regulations and standards vary across countries, environmental compliance costs are high, and cross-border recycling is restricted.

2. Tungsten Product Demand Side

Stable Demand in Traditional Fields

The global industrial chain is partially in disarray and undergoing local restructuring due to the US tariff war, during which the consumption of tungsten products such as cemented carbide in traditional industrial sectors is expected to remain stable.

Expanding Incremental Demand in Emerging Fields

The rapid development and iterative updates in new energy vehicles, wind energy, solar energy, aerospace, semiconductors, and other fields drive the continuous innovation and expansion of tungsten product applications in high-end manufacturing.

Strategic Concerns Spur Reserve Demand

Increased international geopolitical risks and heightened awareness of critical mineral security make the originally stable supply chain potentially face the risk of disruption, thus spurring a reassessment of the strategic value of tungsten resources and strategic reserve demand by enterprises and relevant countries and regions.

3. Policy and Capital Support

Legal and Administrative Controls Intensify Concerns

China's export controls on dual-use items, special operations to combat the smuggling and export of strategic minerals, and strengthened full-chain controls on strategic mineral exports have intensified pressure on the international market supply chain, prompting concerns about future supply risks among relevant parties and triggering a global resource buying frenzy.

Speculation and Investment Intertwine to Strengthen Expectations

In the current international turmoil, China's strategic resource and smelting processing advantages are highlighted, and the strategic resource market is heating up. Although international tungsten prices have already risen and domestic tungsten prices have also been significantly adjusted recently, there is still a lot of room for imagination compared to the price difference between domestic and international critical metals such as rare earths, giving investors future expectations and speculators a motive to enter the market.

III. Three Major Concerns of Overheating in the Tungsten Market

1. Supply-Demand Imbalance: Risk of Inflated Prices

The current round of tungsten price increases is supported by tight supply, but policy expectations and capital speculation have amplified the increases, potentially overlooking the actual demand growth situation. If the global economy is suppressed by US tariff policies, and recovery falls short of expectations or demand in emerging fields slows down, the market supply-demand balance may be disrupted, suppressing prices.

In the context of reduced domestic tungsten mining quotas and export restrictions on important tungsten raw materials such as APT, tungsten oxide, and tungsten carbide, overseas mining companies are eager to seize market share outside China. The accelerated expansion of overseas tungsten mines and concentrated release of production capacity may impact the market, exacerbating price fluctuations; the significant increase in tungsten resource costs provides opportunities and motivations for alternative resources.

2. Policy Variables: The "Double-Edged Sword" of Export Controls

Although China's export controls have pushed up international tungsten prices in the short term, they may trigger countermeasures from trading partners in the long term. European and American countries have already begun to establish strategic reserves and promote supply chain diversification, which may weaken China's pricing power. Leading international tungsten product processing and production companies, under the pressure of resource shortages, are investing more in tungsten ore smelting and recycling resource purification technologies, which may partially offset China's resource advantages. The announcement of the "Joint Statement on U.S.-China Economic and Trade Meeting in Geneva" on May 12, although temporarily alleviating some trade friction risks, the tense trend of resource shortages has already been established.

3. Capital Bubble: The Backlash of Speculative Behavior

Under the current policy environment where China's scrap imports are not liberalized and export controls are becoming increasingly strict, primary tungsten resources are centrally controlled, and there is no mature investment and financing futures market. Speculative funds are limited to short-term hoarding using hotspots, quick entry and exit, which may locally amplify market risks, leading to price increases and instability, but it is difficult to support market prices and regulate peak-valley fluctuations in the long term.

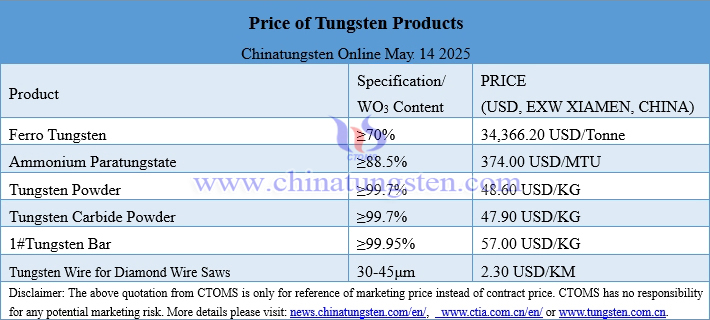

Prices of Tungsten Products on May 14, 2025

Tungsten Price Trend Chart from January to May 14, 2025

![[Know Tungsten] Packaging, Storage and Transportation of Tungsten Flux Packaging, Storage and Transportation of Tungsten Flux](http://www.mteim.com.cn/en/wp-content/uploads/2025/05/tungsten-flux-packaging-en-20250513-214x140.jpg)