Rare earth market update on May 12, 2025

The domestic rare earth market in China is showing a widespread upward trend, primarily due to strengthened export controls on strategic minerals like rare earths and tungsten, rising overseas rare earth prices, and limited growth in domestic spot supply. Today, prices for praseodymium-neodymium oxide, terbium oxide, and dysprosium oxide have risen by approximately 5,000 yuan/ton, 160 yuan/kg, and 30,000 yuan/ton, respectively. Notably, downstream demand is following slowly, so traders should remain cautious.

According to CITIC Securities research, since China implemented export controls on medium and heavy rare earths in April 2025, prices for dysprosium, terbium, yttrium, and gadolinium products in Europe have surged over the past month. Per Argus data, the CIF Europe prices for 99.5% purity dysprosium oxide and terbium oxide have risen to 700-1,000 USD/kg and 2,000-4,000 USD/ton, respectively, approximately tripling in the past month.

The Ministry of Commerce news office reported that on May 9, 2025, China held a special operation meeting in Shenzhen, Guangdong Province, to address the smuggling and export of strategic minerals. The meeting emphasized that strengthening export controls on strategic mineral resources is critical for national security and development interests. Since the implementation of export controls on strategic minerals such as gallium, germanium, antimony, tungsten, and medium and heavy rare earths, some foreign entities have colluded with domestic illicit actors, continually innovating smuggling methods to evade crackdowns. To prevent the illegal outflow of strategic minerals, curb smuggling, safeguard national security, promote compliant trade, and ensure supply chain stability, combating the smuggling and export of strategic minerals has become an urgent and critical task.

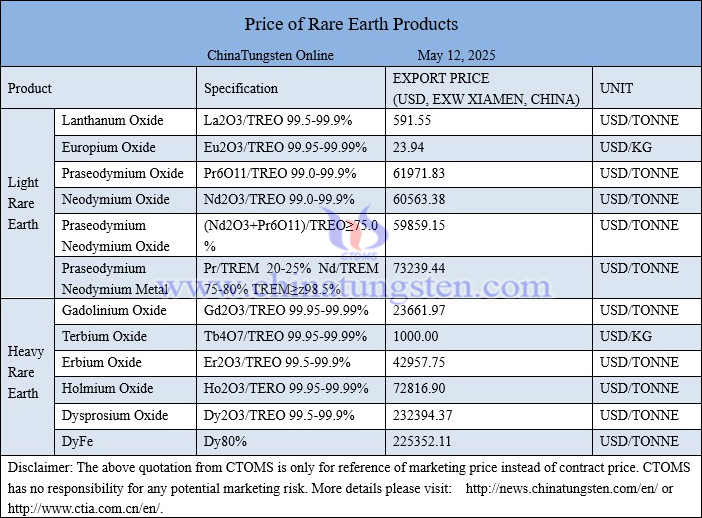

Price of rare earth products on May 12, 2025

Erbium oxide picture