Analysis of Latest Tungsten Market from Chinatungsten Online

This week, the tungsten market continued to rise, with tungsten raw material prices increasing by over 2%, driven by tight supply, cost pressures, and confidence bolstered by upward adjustments in long-term contracts by tungsten enterprises. However, demand has shown no significant improvement, with rising raw material prices and global economic uncertainties intensifying buyer caution.

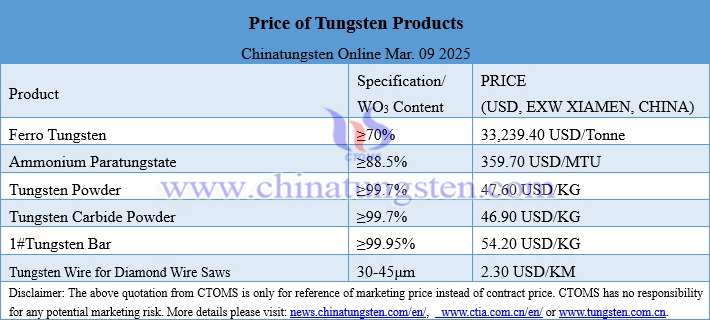

(I) Current Prices of Major Tungsten Products

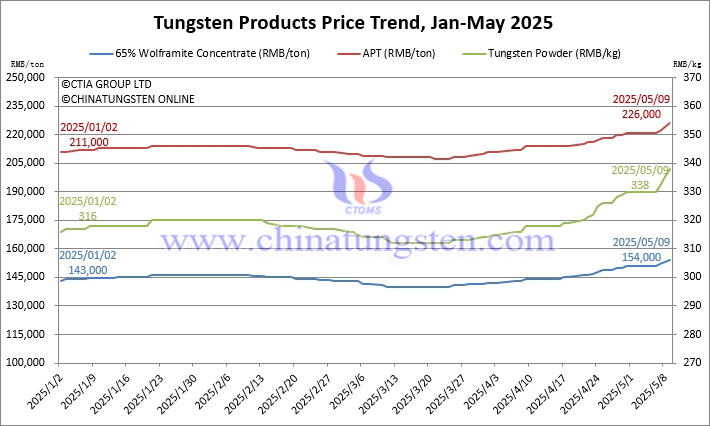

65% Wolframite Concentrate: RMB 154,000/ton, limited supply, bullish sentiment, low trading volume. Prices have risen 10% since late March.

Ammonium Paratungstate (APT): RMB 226,000/ton, driven by production cost pressures, weak consumption.

Tungsten Powder: RMB 338/kg, Tungsten Carbide Powder: RMB 333/kg, cost-driven, demand-constrained, quiet trading.

70% Ferrotungsten: RMB 236,000/ton, supported by firm costs and essential demand, resonating with international markets.

Scrap Tungsten: Prices stable with slight increases, mixed trading confidence.

(II) Current Tungsten Market Fundamentals

Supply Challenges: Declining ore grades and reduced mining quotas heighten supply concerns. Raw material holders are reluctant to sell, pushing tungsten product prices higher.

Demand Performance: Affected by international political and economic factors and high-price aversion, downstream alloy plants and traders are slow to procure, prioritizing inventory digestion. Transactions are mainly driven by essential demand.

Cost Pressures: High raw material costs squeeze smelting profits, forcing downstream industries to accept higher prices. However, limited demand transmission curbs the pace and sustainability of price increases.

Market sentiment: The market is in a high-level running-in stage. Holders are reluctant to sell and hope for price increases, but there is also a mood of profit-taking. The downstream is relatively passive in following the price increase and receiving goods. The overall attitude of traders tends to be cautious, and they are more likely to choose to wait and see rather than actively intervene.

(III) Macroeconomic Updates This Week

China: The first combined interest rate cut and reserve requirement ratio (RRR) reduction of the year was implemented. Starting May 8, the 7-day reverse repo rate in the open market was lowered from 1.50% to 1.40%, a 0.1 percentage point decrease. From May 15, the central bank will cut the RRR by 0.5 percentage points (excluding institutions already at a 5% RRR), expected to inject approximately RMB 1 trillion in long-term liquidity into the financial market. Loose liquidity and lower interest rates may reduce corporate financing costs, but demand stimulus is focused on consumption and technology sectors, with limited impact on traditional tungsten product demand. Continued attention is needed on the central bank’s efforts to optimize capital market tools and their potential support for the industry’s economic environment.

U.S. Federal Reserve: The federal funds rate target range remains unchanged at 4.25% to 4.50%, marking the third consecutive meeting since January and March with no rate changes. Unchanged rates suggest growing expectations of a soft economic landing, which could boost industrial production confidence and potentially support tungsten demand. However, ongoing monitoring of other economic data and policy signals is necessary.

Prices of Tungsten Products on May 08, 2025

Tungsten Price Trend Chart from January to May 9, 2025

![[Know Tungsten] What Is CuCrZr Electrode? CuCrZr Electrode](http://www.mteim.com.cn/en/wp-content/uploads/2025/05/CuCrZr-electrode-photo-en-214x140.jpg)